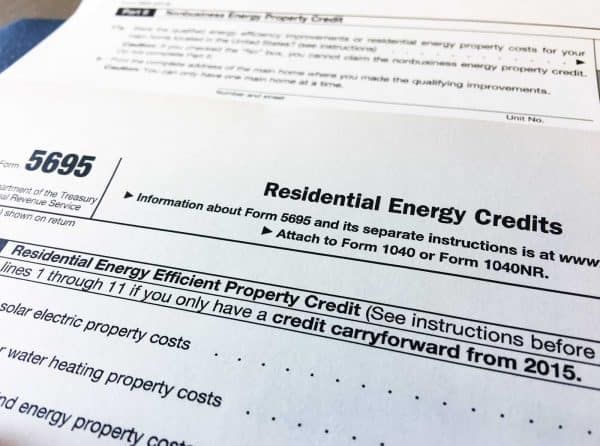

2024 Form 1040 Schedule 5695 Instructions – To take advantage of homeowner tax deductions, you’ll need to itemize your deductions using Form 1040 Schedule A to document your costs on IRS Form 5695. Interest from home equity loans . The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the are not listed on the standard Form 1040. It includes sections for reporting .

2024 Form 1040 Schedule 5695 Instructions

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule 3: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govHow to Claim the Solar Tax Credit in 2024 | Arizona

Source : southfacesolar.com1040 (2023) | Internal Revenue Service

How To Fill Out IRS Form 5695 to Claim the Solar Tax Credit

Source : palmetto.comIRS Releases Form 5695 Instructions and Printable Forms for 2023

Source : www.wicz.comGet ready to file in 2024: What’s new and what to consider

Source : www.wlbt.comHow to Claim the Solar Tax Credit in 2024 | Arizona

Source : southfacesolar.com2024 Form 1040 Schedule 5695 Instructions 2023 Instructions for Form 5695: Gather each tax form you need to fill out for the type of business you own. Sole proprietors may only need the form 1040, Schedule SE each form according to the instructions, making sure . However, a Schedule C form is required there are no special instructions to follow, except what is normally required for sole proprietorships. Complete IRS 1040 Schedule C, “Profit Or .

]]>